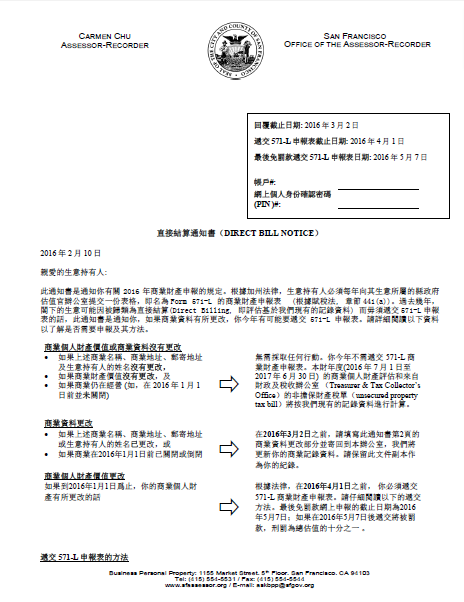

Direct Bill Notice (Chinese - 年商業財直接結算通知書)

If the assessed value of your personal property of the prior year is less than $50,000, you may not be required to file the Business Property Statement, Form 571-L. Instead, you will receive a Direct Bill Notice. If you receive a Direct Bill Notice, your tax bill will be based on the assessed value from prior year. In case there is a change in your business, such as, a change in value, you may file your statement online by using the provided account number and PIN (Personal Identification Number), and follow the instructions on the letter.

Last updated: 11/07/18