Forms

-

Leased Equipment Detail Report

The Leased Equipment Detail Report is one of two (2) templates provided by the Business Property Division of the Office of the Assessor-Recorder to assist lessors report equipment out on lease in the City and County of San Francisco.

-

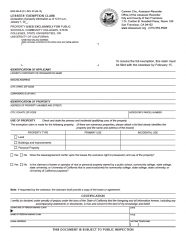

Lessee’ Exemption Claim B

BOE-263-BLeased property used exclusively by and for Public Schools, Community Colleges, State Colleges, State Universities, or University of California.

-

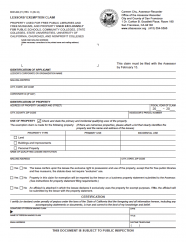

Lessors' Exemption Claim

BOE-263Exempts property owners from real property or personal property taxes who leases to Churches, Public Schools, Community and State Colleges, State Universities, Nonprofit Colleges, Free Public Libraries and Free Museums and provides compensation to them in the form of rental reduction or refund.

-

Lower Exemption, Family Household Income Reporting Worksheet

BOE-267-LAWorksheet provided to each household living on property. To accompany claim seeking exemption for low-income housing that is owned and operated by a nonprofit organization.