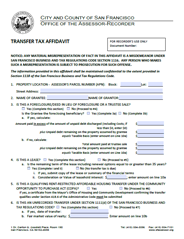

Transfer Tax Affidavit

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable. Transfer tax is based on the purchase price if it is a purchase. Otherwise, it is based on the fair market value of the property being transferred. Additionally, transfers of leaseholds with a term of 35 years or more are subject to transfer tax. If the person completing the form is claiming an exemption, is this exemption valid? Copies of trust and formation documents of legal entity (i.e. LLC operating agreement, Corporate By Laws/Minutes/Register, partnership agreement) to prove the claimed transfer tax exemption are always required. Please note that exemptions from reassessment and exemptions from transfer tax may differ.

Submission Deadline: At the time of submitting a Deed (all types), a Memorandum of Lease, a Grant of Easement, an Assignment of a Lease, an Assignment of a Sublease, or an Unrecorded Legal Entity Transaction, even if no transfer tax is due.

Last updated: 10/16/24